A Simple Service for

Peace of Mind, Quality of Life, Best Value

Offering you access to the most competitve rates.

Guiding you to the best decision for you unique situation.

Our Services

Please select an Insurance Plan.

Raving Reviews

What our clients says about us.

Kimberly Wolff

Happy Client

108 - 5 Star Reviews

Rated Review by Kimberly

F.A.Q.

Insurance rates can increase due to factors like inflation, rising repair costs, increased claims in your area, or changes in your personal risk profile. Even if you haven’t filed a claim, industry-wide trends and economic shifts can impact your premium.

Increasing your liability limits provides greater financial protection if you’re found responsible for an accident or damage. Medical bills, legal fees, and property repairs can add up quickly, and higher limits help ensure you’re not left paying out of pocket for expenses beyond your coverage.

Liability insurance covers damages or injuries you cause to others in an accident, while comprehensive and collision insurance protect your own vehicle. Comprehensive covers non-collision incidents like theft, vandalism, or natural disasters, while collision covers damage from a crash, regardless of fault.

Home liability insurance covers you if someone is injured on your property or if you accidentally cause damage to someone else’s property. It can help pay for medical bills, legal fees, and settlements, protecting you from costly out-of-pocket expenses.

Uninsured and underinsured motorist coverage protects you if you’re in an accident caused by a driver who has little or no insurance. It helps cover medical expenses, lost wages, and other costs that the at-fault driver’s insurance should have paid, ensuring you’re not left with unexpected financial burdens.

A general liability policy protects your business from financial losses due to third-party claims of bodily injury, property damage, or advertising injury. It helps cover legal fees, medical expenses, and settlements, ensuring your business isn’t financially devastated by lawsuits or accidents.

In The Community

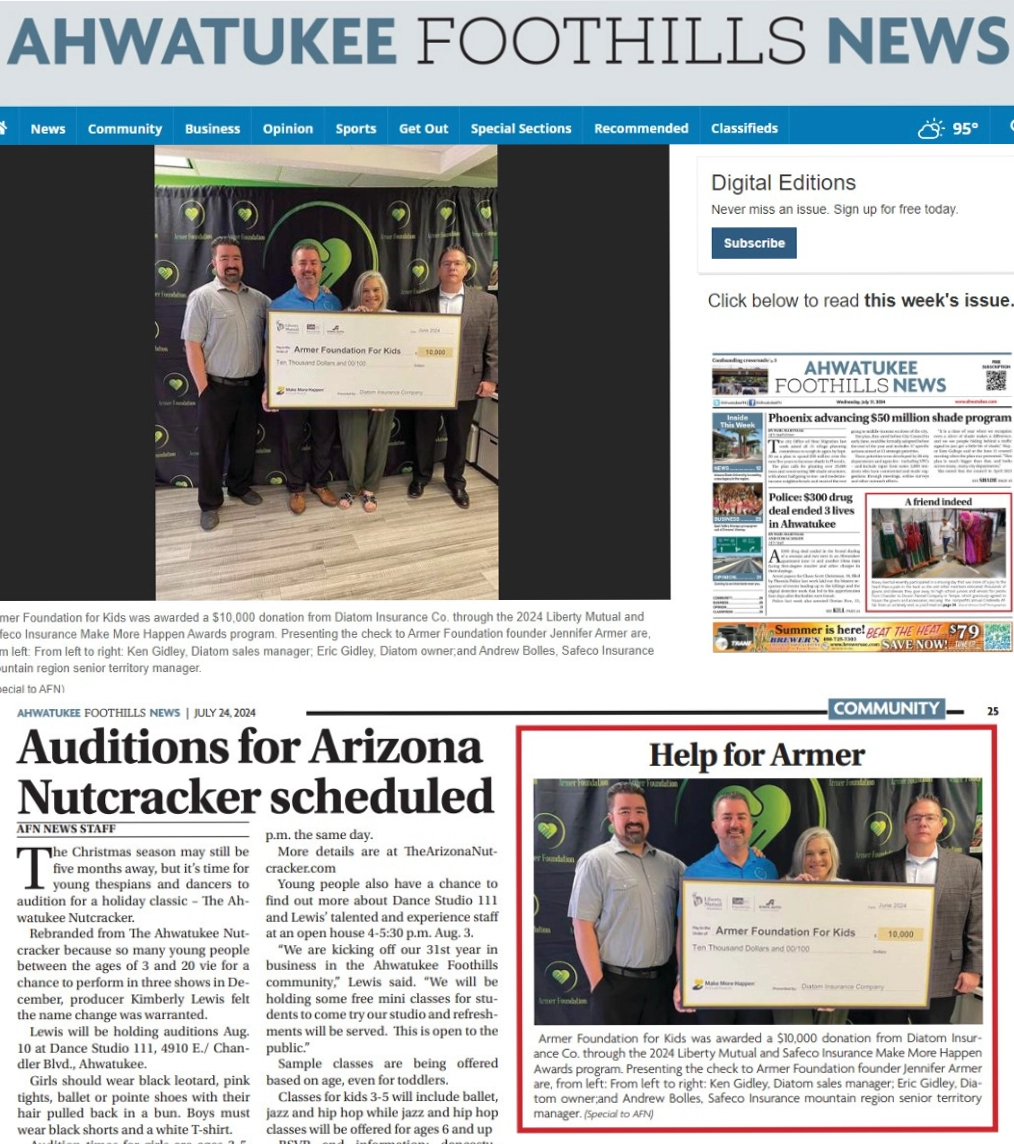

Armer Foundation for Kids was awarded a $10,000 donation from Diatom Insurance Co. through the 2024 Liberty Mutual and Safeco Insurance Make More Happen Awards program. Presenting the check to Armer Foundation founder Jennifer Armer Eric Gidley, Diatom owner; and Andrew Bolles, Safeco Insurance mountain region senior territory manager

Perfect Solution For Your Business

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Neque porro quisquam est, qui dolorem ipsum quia dolor sit amet.

- Lifetime Guarantee

- 24/7 Support